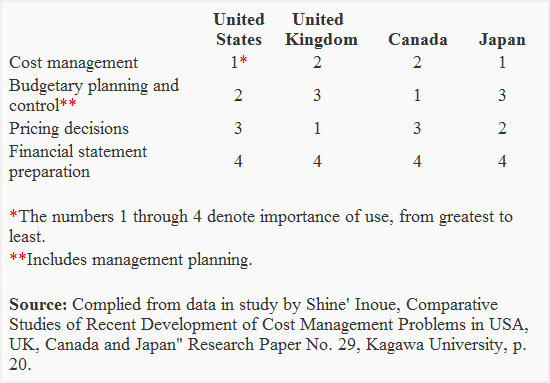

Once historical data is collected, businesses must consider industry benchmarks. These benchmarks offer a comparative perspective, allowing companies to gauge their performance against industry standards. By aligning their cost expectations with these benchmarks, businesses can ensure that their standard costs are competitive and reflective of broader market conditions. This step is particularly important for companies operating in highly competitive industries, where cost efficiency can be a significant differentiator. The company usually conduct the testing to estimate a proper standard cost of each production unit. With this cost, they will be able to calculate the inventory valuation, cost of goods sold, which will impact the profit during the period.

What is Accounting Equation? Example, Procedure of Forming

For example, if XYZ company expected to produce 400 widgets in a period but ended up producing 500 widgets, the cost of materials would be higher due to the total quantity (volume) produced. The efficiency of management depends on the control of costs, among other factors. To control costs effectively, management needs to know the actual cost, as well as the variation between the expected cost and actual cost. By establishing standard costs, organizations can streamline budgeting processes and enhance decision-making efficiency.

Direct Materials Variance

Lean accounting is related to lean manufacturing and production, which has the stated goal of minimizing waste while optimizing productivity. For example, if an accounting department is able to cut down on wasted time, employees can focus that saved time more productively on value-added tasks. In responsibility enrolled agents vs cpas accounting, managers are evaluated based on their performance over things they can control. Actual performance is compared with expectations or established standards. Explore the essentials of standard costing, from key components and calculations to its impact on budgeting and financial statements.

Report calls for fair value accounting on federal loans

- They believe that there is no machine breakdown, worker tea break, or any error in the production process.

- In this way, managers can set realistic production / sales quotas for each product while determining the cost of such products.

- That component of a product that has not yet been placed into the product or into work-in-process inventory.

- This step is particularly important for companies operating in highly competitive industries, where cost efficiency can be a significant differentiator.

- Nobody wins, the government pays a higher price, thecontractor is exposed to an allegation of defective pricing, and riskslosing contracts that might have been won under ABC.

- The costs that should have occurred for the actual good output are known as standard costs, which are likely integrated with a manufacturer’s budgets, profit plan, master budget, etc.

A variance can also be used to measure the difference between actual and expected sales. Thus, variance analysis can be used to review the performance of both revenue and expenses. The $100 credit to the Direct Materials Price Variance account indicates that the company is experiencing actual costs that are more favorable than the planned, standard costs.

All of our content is based on objective analysis, and the opinions are our own. These standards make proper allowances for normal recurring interferences such as machine breakdown, delays, rest periods, unavoidable waste, and so on. A cost center is a location, person, or item of equipment (or a group of these) for which costs may be ascertained and used for the purpose of cost control. This section highlights the most important advantages of standard cost. Also, standard cost may be expressed in terms of money or other exact quantities.

Impact on the Financial Statement

Standard cost involves different elements of costs, such as material, labor and overheads, in respect of a product. The essence of standard costing is to set objectives and targets to achieve them, to compare the actual costs with these targets. Standard Costing is used to ascertain the standard cost under each element of cost, i.e., materials, labours, overhead.

It means that the actual costs are higher than the standard costs and the company’s profit will be $50 less than planned unless some action is taken. The variances arising from expected standards represent the degree of efficiency in usage of the factors of production, variation in prices paid for materials and services and difference in the volume of production. These standards reflect the management’s anticipation of what actual costs will be for the current period. These are the costs which the business will incur if the anticipated prices are paid for the goods and services and the usage corresponds to that believed to be necessary to produce the planned output.

The business you are in affects the type of records you need to keep for federal tax purposes. Your recordkeeping system should also include a summary of your business transactions. This summary is ordinarily made in your business books (for example, accounting journals and ledgers). Your books must show your gross income, as well as your deductions and credits.

This method will always update to reflect on current business operations. So they can use over a long or short time based on how fast the change in business. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. In setting standards, the key question is to decide on the type of standard to be used in fixing the cost. The main types of standards are ideal, basic, and currently attainable standards.